Investing is the act of committing financial resources with the expectation of receiving an additional gain or profit from such allocation. In simpler terms, investing is buying an asset with the goal of generating a return on its value in the future.

There are many reasons why investing is important. One of the primary reasons is that it enables individuals to improve their financial status. Investing can help an individual generate additional income and build wealth over time. It is a useful tool to combat the impact of inflation and increase the purchasing power of one’s savings.

Another reason why investing is important is that it allows individuals to meet their financial goals. For instance, saving and investing for retirement is one of the most common financial goals for many people. Investing in various asset classes, such as stocks, bonds, and mutual funds, provides a way to generate returns that can fund such goals.

Investing is also important in creating financial security and stability. With the right investment plan in place, individuals can build a solid financial foundation that secures their future.

In addition, investing enables individuals to take advantage of opportunities that present themselves. This could be in the form of purchasing undervalued stocks during a market downturn or investing in a promising start-up company. With the right strategy, investing can result in significant growth over time.

Furthermore, investing in specific assets can have an impact on the economy at large. For instance, investing in socially responsible companies promotes sustainable practices, fostering a culture of social responsibility.

When it comes to investing, it is important to have a well-diversified investment portfolio to help minimize risk and maximize returns. The practice of diversification involves investing in a variety of assets, which reduces the risks associated with investing in a single asset. The main objective of portfolio diversification is to avoid putting all of your eggs in one basket.

Fixed deposits, or FDs, are one of the most popular investment options available today. They are offered by banks and non-banking financial companies (NBFCs) and are a low-risk investment. FDs offer a guaranteed rate of return, with the interest rate fixed at the time of investment. These instruments are ideal for individuals who want to earn a higher interest without taking on market risks.

The advantages of fixed deposits are numerous. Firstly, FDs are easy to understand and manage. Investors do not require any special knowledge or expertise to invest in fixed deposits. Secondly, FDs offer a fixed rate of return, which is not subject to any market fluctuations. This means that investors can calculate the return on their investment beforehand and plan their financial goals accordingly.

Thirdly, with the advent of digital fixed deposits, investing in FDs has become even more convenient and lucrative. Bajaj Finance Fixed Deposit is one such option that provides a hassle-free and safe investment experience. Its Digital FD option is a great option for those who want to invest in FDs digitally. With the new interest rate of 8.85% per annum, it is the perfect option for those who want to earn higher yields on their investment. This rate of interest is only applicable for customers booking FDs online, which makes it an even more attractive option for those who prefer digital banking.

Fixed Deposits (FDs) are a popular investment option that provides investors with guaranteed returns on their principal investment amount. They are offered by banks, non-banking financial companies (NBFCs), and post offices. FDs are classified as a safe investment option since they offer guaranteed returns and are not subject to the volatile fluctuations of the stock market.

Under a fixed deposit plan, an investor can deposit a lump sum amount for a fixed period, which ranges from a few days to several years, with a specific interest rate. The rate of interest is determined at the time of investment and remains constant for the entire duration of the deposit period. When the deposit matures, the investor receives the principal amount, along with the interest earned on it.

Fixed Deposits have several advantages that make them such a popular investment option. Firstly, they offer higher interest rates than savings accounts and are a safe investment option. The interest rates of FDs are not subject to market fluctuations and remain stable for the entire duration of the deposit. Secondly, they are easy to understand and manage, requiring no special skills or knowledge to invest. FDs allow investors to calculate and plan their returns conveniently and make financial goal planning easier.

Fixed Deposits offer a high degree of liquidity; an investor can withdraw their deposit before the maturity period with some loss of interest. This makes FDs an ideal investment option for individuals who require emergency funds. In addition, premature withdrawal of fixed deposits also carries a penalty charged by the bank or NBFC.

Fixed Deposits also come with tax benefits. Under Section 80C of the Income Tax Act, the amount invested in FDs up to Rs. 1.5 lakhs is allowed as a deduction from taxable income. Additionally, senior citizens can benefit from higher interest rates offered by banks.

Apart from the Bajaj Finserv App’s Digital Fixed Deposit option, there are several other apps and options for fixed deposits that investors can choose from. Some of the popular options include Fixed Deposits by ICICI Bank, HDFC Bank Fixed Deposits, and YES Bank Fixed Deposits. Each of these options has its own set of advantages and disadvantages.

It is important to note that investors should not rely solely on fixed deposits for their investment portfolio diversification. A well-diversified portfolio should include a variety of assets, including stocks, bonds, mutual funds, and real estate. By diversifying the portfolio, investors can spread the risk and generate higher returns over the long term.

Fixed deposit apps have made the process of investing in fixed deposits easier and more convenient than ever before. These apps offer features such as easy account opening, convenient fund transfer, and flexible deposit options. Some of the top-rated fixed deposit apps in India include SBI Fixed Deposit App, Axis Bank Fixed Deposits, and Kotak Mahindra Bank Fixed Deposits.

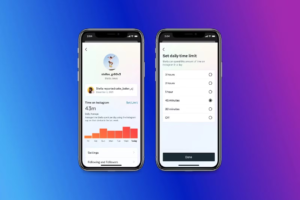

Key features of fixed deposit apps include the ability to calculate interest earnings and compare different FDs offered by different banks. Furthermore, investors can choose the FD tenure and deposit amount that suits their needs and goals. The best advantage of fixed deposit apps is the convenience they offer, enabling investors to track deposits, get alerts, and access their investment at the click of a button.

In conclusion, diversification is a key aspect of investing that helps reduce the risks associated with investing in a single asset. Fixed deposits are a safe and low-risk investment option that can be used to diversify an investment portfolio. Digital fixed deposits, via investment apps, make investing in fixed deposits easier and more convenient than ever before. By diversifying their investment portfolio and periodically evaluating and rebalancing it, investors can maximize their returns and secure their financial future.